Precious metals are benefiting from a broader destabilization in global financial markets, which is weighing on the US dollar and potentially on demand for US Treasuries. The diversification trend away from Treasuries appears strategic and long-term in nature, supporting the fundamental backdrop for gold in particular. Goldman Sachs has raised its 2026 gold price target to $5,400 per ounce, up from $4,900 previously.

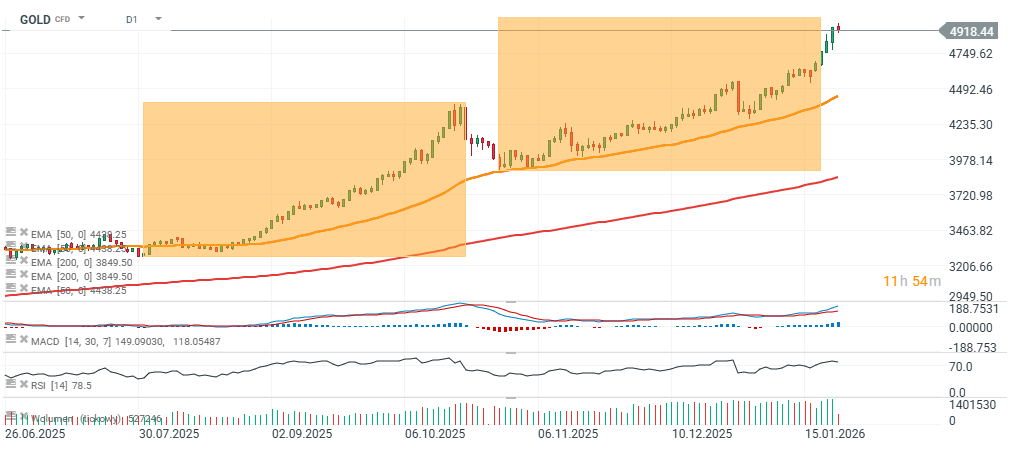

- If we assume the next leg in gold follows a 1:1 pattern similar to the two prior impulses—and that the corrective phases also respect a 1:1 structure—this would imply a potential pullback toward $4,400 before a new upside impulse. In that scenario, the next move could be roughly $1,000 higher, taking gold toward $5,400 per ounce, broadly in line with Goldman’s projection.

- The two previous upward impulses (July–October, and mid-October–January 2026) each delivered gains of around $1,000 per ounce. If the corrections were to be comparable as well, a pullback of roughly $500 would be consistent—pointing to a potential test of the $4,400 area. That said, there is no certainty that gold will continue to follow this pattern, or that a 1:1 correction must occur at this stage.

The biggest risk for gold and the broader metals complex appears to be Jerome Powell remaining in charge of the Fed—an outcome that would likely reduce the chances of implementing a “Trump model,” in which the Federal Reserve cuts rates aggressively while tolerating inflation near target. Even so, such a scenario would not necessarily prevent foreign central banks and large funds from deciding to reduce exposure to Treasuries. Against the backdrop of escalating tensions around Greenland, this is a debate that could increasingly matter for Nordic countries and pension funds in Northern Europe, not only for BRICS nations.

GOLD (D1 timeframe)

Source: xStation5

Cocoa crashes 7% 📉

Market overview: PMI shapes European markets🚨

Silver surged 40% in January moving toward $100 per ounce📈

Chart of the day: EURUSD under pressure after PMI data! 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.